LEGACY | June 2023

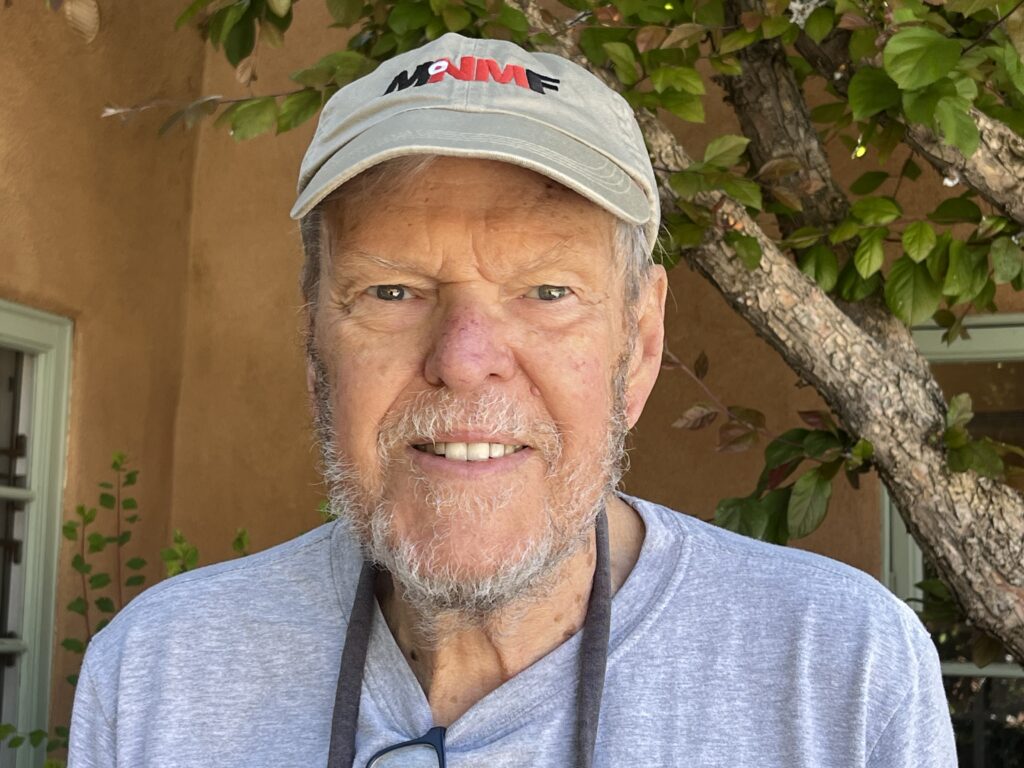

Image: Bruce Larsen, MNMF Trustee.

Consider Funding a Charitable Gift Annuity with a Qualified Charitable Distribution from your IRA- This Year Only!

A charitable gift annuity is a simple contract between you and the Museum of New Mexico Foundation promising to pay you a fixed amount of money each year for life. The amount paid to you will depend upon your age at the time of your gift and does not change for the rest of your lifetime.

A Qualified Charitable Distribution is a contribution from your IRA. You can make a Qualified Charitable Distribution if you are at least age 70½. Unlike most distributions from your retirement account, you pay no income tax on a Qualified Charitable Distribution.

Under the new law, donors can now make a Qualified Charitable Distribution in exchange for a charitable gift annuity. There are some rules and limitations. You can do it once during 2023 only and there is a limit of $50,000. The entire payment you receive from your charitable gift annuity will be subject to income tax. There is no income tax deduction for your contribution (although there is no tax on your Qualified Charitable Distribution either).

Bruce Larsen, MNMF Trustee and Chair of MOIFA Advancement Committee, has chosen to take advantage of this new opportunity to receive quarterly pay-outs and to benefit the Girard Legacy Endowment Fund. Thank you, Bruce!

Please contact Laura Sullivan at laura@museumfoundation.org or 505.216.0829 for more information. Please be sure to work with your tax or financial advisor to determine how this new option might work for you.

Connect